OEMs, UBER: Your branding will be toast by 2030

OEMs, UBER: Your branding will be toast by 2030.

Last week I was investigating a potential trip to Europe to meet my family this summer. After some research, we decided where we wanted to go and I began to investigate the quickest and cheapest way of getting 2 adults and 2 kids across the Atlantic. A few days later, a friend asked me which airline I was thinking of taking and the hotel I wanted to stay at, and my answer was "I don't know, but I was looking on Expedia."

This story tells you all you need to know about the direction of Automotive Branding in New Mobility.

To date, a new automotive purchase has almost always been a transaction directly through the manufacturer branded dealership on an in-person basis. This direct manufacturer (manufacturer branded) to dealer to customer relationship has allowed manufacturers to develop their brand to an extremely high level of consumer recognition, and it has also allowed them to go about creating their own strong brand identity. For example, when you think Mazda, you automatically think "Zoom, Zoom"; an everyday car with a fun to drive personality. When you think Jeep, you think rugged SUV climbing up a rock face. BMW is of course "The Ultimate Driving Machine." Manufacturers have gone to great lengths and expense to cultivate their brand image, and have been able to successfully link the direct branding relationship between manufacturer, dealer and product.

Manufacturers have gone to great lengths and expense to cultivate their brand image

However, under New Mobility, a changing hegemony will occur, eventually breaking into two very strong "Branding Chains."

1) Driving will no longer break the experiential Branding Chain

Today, the way that most manufacturers try to tap into in their branding is through the active experience of driving. The 'feel of the road,' the 'powerful acceleration,' the 'road holding and handling' experiences will be lost in exchange for a much more passive passenger relationship. Thus people's ability to relate to their vehicle and identify with it will be much lower. Just as people don't identify with or care about the brand of bus or train that they ride in every day.

2) Ridesharing breaks the Manufacturer to Dealer to Customer Branding Chain

As autonomous vehicles and ridesharing become popular, people will not care what brand of vehicle they travel in, just as few people currently care about what taxi or Uber vehicle brand they hail. But, are we sure that the trend of carsharing and ridesharing will grow? Yes, and the reason is directly related to the hip pocket. For 90% of vehicles purchased, the top 2 reasons for purchase are always money related, and these can be summarized as "Cost to purchase / deal received" and "Cost of ownership / Fuel economy." More emotional reasons, such as fun to drive, styling and engine performance almost always rank below the hip pocket rationale. In a recent study by Columbia University, they forecast that the average cost of ownership for a driver who does 10,000 miles per year will fall from the present 85c per mile to just 15c per mile with purpose designed autonomous shared vehicles, a spectacular 84% reduction. In other words, customers are attracted to low transportation costs and will very likely follow that direction if an amazing deal is presented to them - with the obvious caveat that convenience is not significantly reduced.

For 90% of vehicles purchased, the top 2 reasons for purchase are always money related

So how does this apply to branding? As vehicles move towards a shared passenger only experience, people will move strongly towards finding the quickest and cheapest way to get from Point A to Point B.

Thus the current branding ability for manufacturers to influence a consumer's purchase habits becomes much more difficult.

Mobility as a Service (MaaS) Apps, or much more likely the digital assistant in your smart phone, that call a self-driving taxi bot will focus on finding and calling the closest one first to ensure maximum convenience, no matter the vehicle brand or mobility company. Just like my travel example where I went to Expedia first, the true brand will become the MaaS App / Digital Assistant platform that calls the closest taxi-bot, and maybe second, a mobility provider, like Uber. Just like OEMs, Uber's brand will also significantly suffer since the brand focus and interaction is no longer on them as they will offer a generic and easily repeatable service. The only way forward will be for Uber to offer incentives or loyalty type programs that will cause the consumer to wait a little longer for an Uber instead of a competitor.

Thus the current branding ability for manufacturers to influence a consumer's purchase habits becomes much more difficult[LR1].

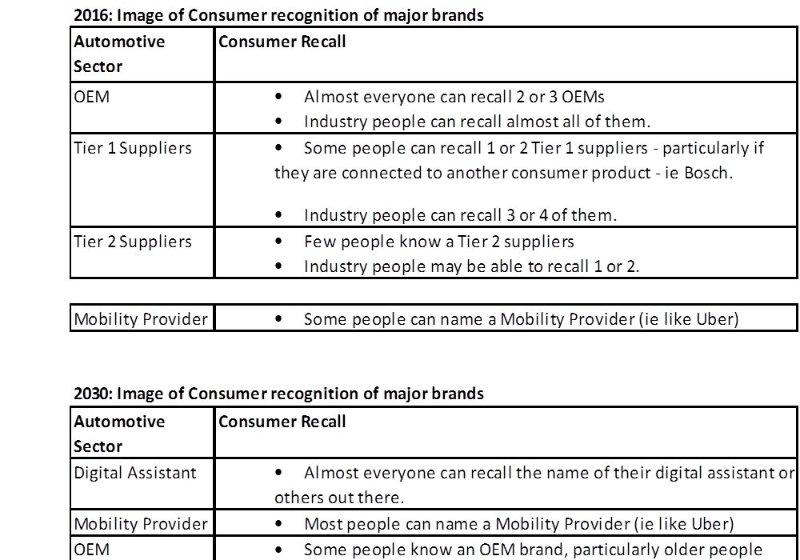

Here is an image of what a consumer brand recall situation would look like today vs one in 2030 (Sector at top, closest to customer).

As you can see, the closer the customer is to the purchase decision, the better the ability for the company to brand their product. As OEMs and Uber move further away from the customer, branding will be more difficult. Thus mainstream OEM brands, and to a lesser extent mobility companies, stand a much lesser chance of being recognized in a New Mobility world, which dramatically opens the possibilities for Chinese brands, who currently can't compete due to negative brand connotations, to enter established markets such as Europe and North America because no one will care what brand of taxi bot they are riding in.

OEM brands..... stand a much lesser chance of being recognized in a New Mobility world[LR2]

The main caveat to this will be the luxury market and 'driver' market. Luxuriously equipped and branded taxi bots will be able to charge more for their fares or purchase price, and there will still be a significant part of the market that wants to own their vehicle in some form due to status symbols, convenience, private space or active driving reasons. As soon as you want 'arrive' and make an impression, luxury is a pre-requisite that you will have to pay for, just as the experience of actively driving yourself will become.

So where does this lead us? New Mobility will likely have a very negative impact on mainstream automotive brands and their ability to tap into the rich private buyer market will be greatly reduced. To survive, manufacturers will need to focus on low cost, low margin fleet purchases, or alternatively, focus more on luxury, where margins, both on a purchase and shared vehicle basis, will continue to remain above that of the mainstream.

New Mobility will likely have a very negative impact on mainstream automotive brands

There will, however, be a significant change in the way automotive branding occurs. The car will no longer be the brand; it will become the platform on which other brands are promoted. As autonomous vehicles will no longer require a driver, they can be equipped with giant TV screens that quickly turn them into rolling billboards, able to gain multiple impressions from people with nothing to do as soon as they take a ride in the vehicle. With the amount of time we spend commuting, this quickly becomes a captive audience, and the ability to capture data about our daily habits and interact with the brands they are promoting will be huge. This is the reason that Ford has started to focus energy on its Ford Pass platform as a way to tap into this ultra-connected consumer.

The car will no longer be the brand; it will become the platform on which other brands are promoted.

The way forward for Automotive and Mobility branding will be to no longer have the vehicle or service as the brand focus, but rather promote it as a rich brand promotion machine, and the car itself is the platform on which this huge opportunity is based.

Footnote: A big thank you to Alex Renz who helped out with the ideas and direction of this article.

About the author: James Carter is a 20 year Automotive Industry veteran and now serves as Principal Consultant at Vision Mobility, an Automotive and Mobility Consultancy specializing in Autonomous Vehicles and Future Automotive Planning; in Sales, Marketing, Branding, Product Planning, Dealer Development, Sociographic trends and Infrastructure planning.

[LR1]Est-ce que ce texte peut apparaitre au bon endroit pour ne pas briser le flow?

[LR2]Même commentaire